St John’s Wood – Prime Central London’s Evergreen Growth Market

Gary Hersham is the Director and Founder of Beauchamp Estates. In this article, he talks about St John’s Wood as an evergreen market in prime central London.

St John’s Wood, the leafy residential enclave immediately north of London’s Regent’s Park, has proven to be a resilient and increasingly ‘evergreen’ star of London’s ultra prime property market, experiencing increases in values and volumes.

Popular with people of all nationalities who appreciate its relaxed urban village lifestyle, proximity to good schools and historical and leafy features, St John’s Wood is finding new and increasing relevance and value in a much-changed world.

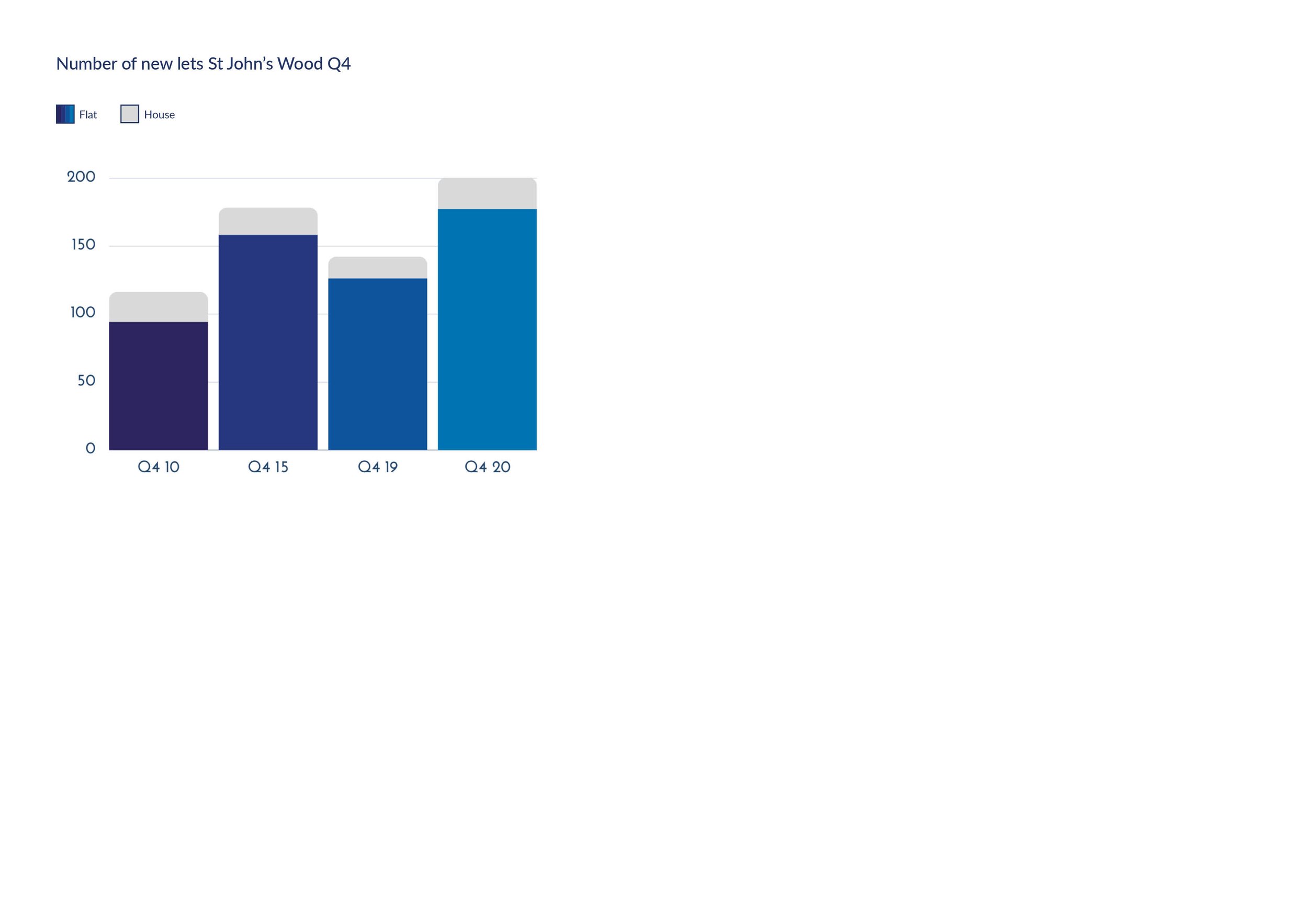

The latest market research report from Beauchamp Estates reveals that St John’s Wood has unexpectedly benefitted from the pandemic pandemonium that has hit many of the world’s prime property markets hard. House sales in the leafy prime central London market have increased by 41% in volume and 12% in value (year on year).

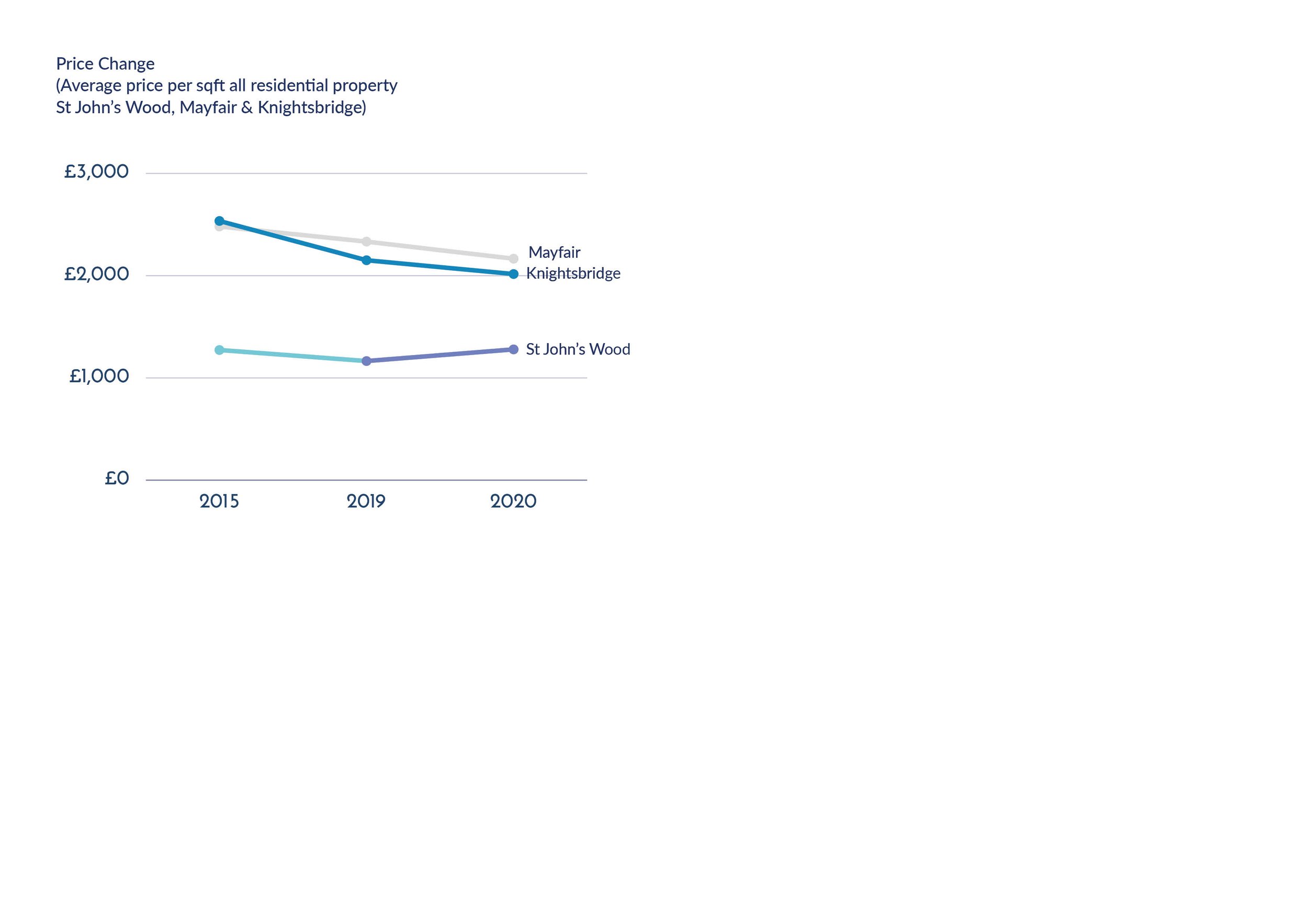

The in-depth report looks at the history of St John’s Wood, its appeal, the performance of the property market, sales and lettings, over the last 10 years and compares its performance to both Mayfair and Knightsbridge. Interestingly the price premiums per square foot for both areas remain high at 69.3% and 57.6% respectively, yet St John’s Wood has outperformed both areas in terms of average year-on-year price growth at +9.8%, compared to average price decreases of -7.2% and -6.3% respectively.

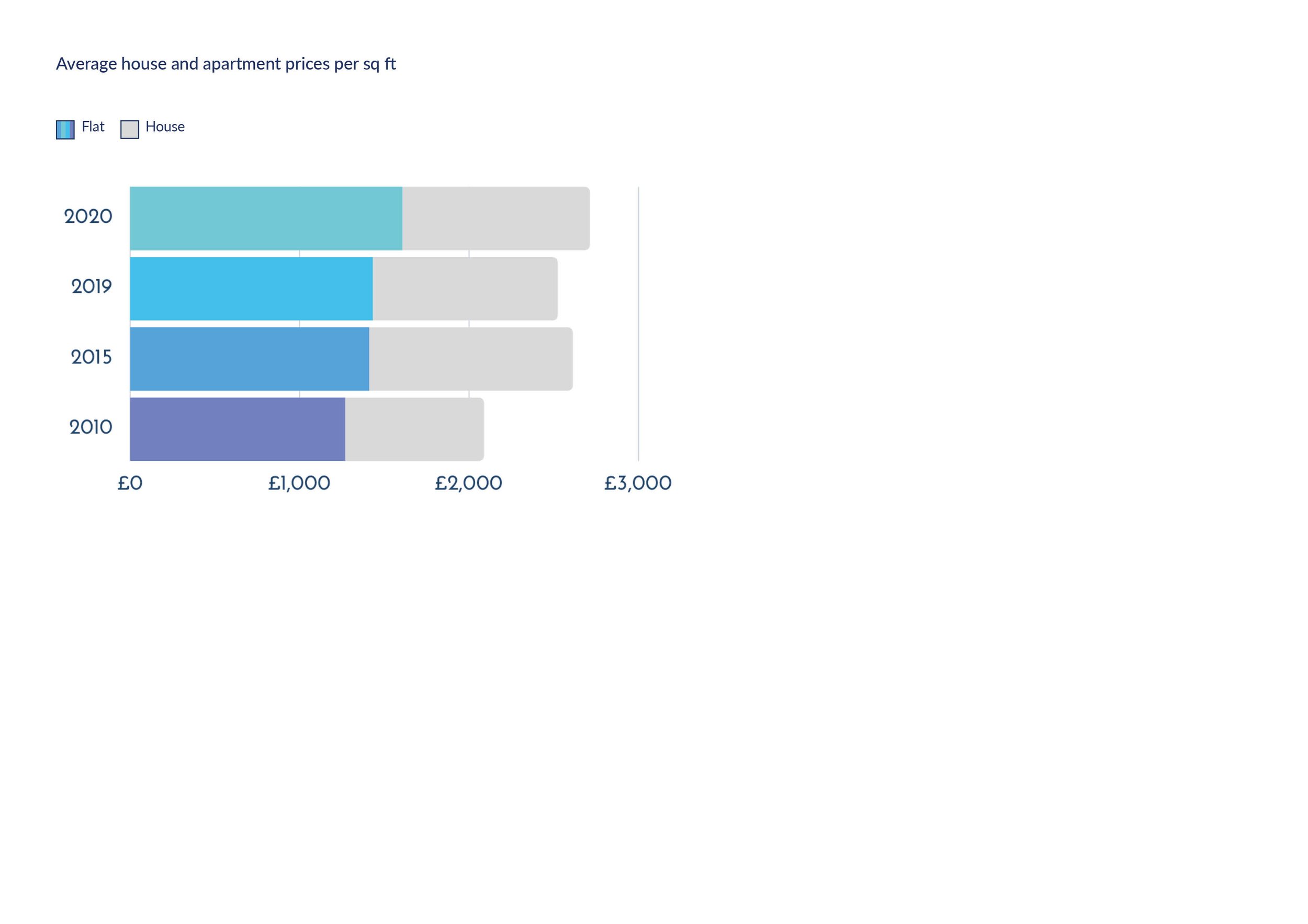

What is clear, in all three markets, is that there is a very clear divide in performance between the sale of apartments versus houses. As buyers have experienced changes in their domestic arrangements, driven by the pandemic, such as home schooling, home working, quarantine and have generally seen the amount of time spent at home (inside and outside) increase, many have reviewed their needs, placing greater importance on internal space (volume) and access outside space, ideally private.

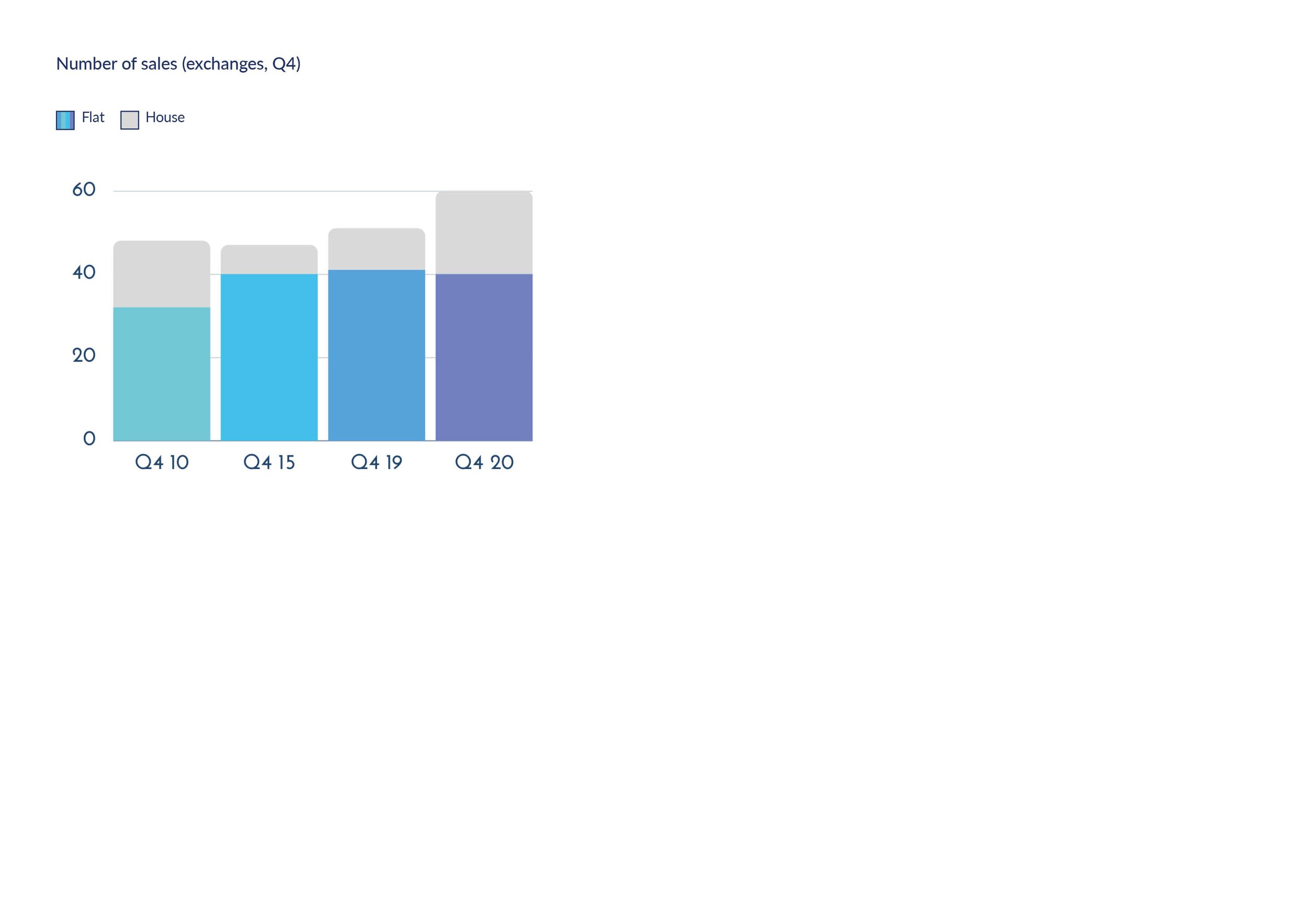

The apartment market in all three areas has seen a decrease in volumes and values, particularly in Knightsbridge, with sale volumes down -25.8% year on year and where there is a greater reliance on international buyers who have been absent from the market due to international travel restrictions. In comparison St John’s Wood apartment volumes were down only -14.1% and Mayfair -7.4%.

The picture for house sales is quite a different view where volumes in Mayfair, Knightsbridge and St John’s Wood were up year on year, +14.3%, +11.5% and +41% respectively, with only St John’s Wood recording a price per square foot increases at +12.1%.

Despite there being generally fewer houses available in Mayfair and Knightsbridge, making volume analysis sensitive, there is little price premium on a cost per square foot basis for houses over apartments, something that does not hold true in St John’s Wood, where the premium per square foot for houses can be as high as 45%. This extraordinary increase in premium is driven predominantly by the size of plot on which a house is located and access to both outside space and private outside space: something that has been a key performance driver in the market in general.

The larger houses in St John’s Wood (many found on Avenue Road, Cavendish Avenue (West Side), Acacia Road and Hamilton Terrace) come on exceptionally large plots, far greater than comparable properties in Mayfair and Knightsbridge and generally speaking are subject to less restrictions in regard to development activity of single dwellings – something many Belgravia residents might well envy.

Houses on these larger plots are set to become increasingly prized, not necessarily as much for their development or redevelopment potential, but for the ability to secure and manage the integrity of private outside space. This will be increased further by the extremely limited opportunity for legitimate new build houses, placing an ever-increasing premium on existing stock. St John’s Wood is the only area in prime central London that offers houses with gardens, many with large gardens.

The Head of our St John’s Wood office, Rosy Khalastchy, who has lived and worked in the area for over 30 years and has always seen the appeal of area commented, “The High Street and its urban village feel appeals to a wide range of people, but recent changes in buyers’ priorities have seen unprecedented interest in the area, particularly for larger houses.

Houses in the very best locations, turnkey, ready to move into can command over £45 million – pre-pandemic there was greater buyer appetite for development properties, but the challenges of undertaking work at this time coupled with people’s desire not to wait has created a demand at the very top end of the market.

The market changes have also impacted the stock that is currently available: two years ago there were a number of larger houses that were experiencing difficulties finding buyers: two years on they have either been sold or secured long-term tenants. Currently there is little quality stock available.

While there are no genuinely ‘new’ standalone houses coming to market, the pipeline of new developments will bring a limited number of houses and apartments to the market over the next five years or more. Planning consent has been granted for over 490 privately owned homes to be built, many of which are being built to a high specification and come with a range of services and private facilities – this includes projects like One St John’s Wood, St John’s Wood Square, The Landseer and a small development in the prestigious location of Hamilton Terrace, which we are working on with the developer.

The advent of COVID has impacted many prime real estate markets around the world, primarily in terms of buyer priorities, none of which has resulted in the mooted mass exodus from cities, though it has reshaped demand and for some changed choice of location.

I have experienced some clients trading Mayfair and Knightsbridge for Surrey, but many more have traded them for Regent’s Park and St John’s Wood – on a long-term basis property close to central London and protected green space is always likely to see positive capital growth and yield increases.

The prime central London market has been increasing its geographical spread over recent years, creating the ultra prime sales and letting market in Regent’s Park, the subject of a 2019 report by Beauchamp Estates, moving on through to the northern reaches of St John’s Wood, to gradually connect with Hampstead.”

The appeal of St John’s Wood shows no sign of diminishing, and its upward trajectory of appeal and price seems set to continue, as buyers place an ever-greater emphasis on space, green space and living local, particularly in times of restricted or curtailed freedoms, such as those brought about by Coronavirus.

While house prices in St John’s Wood have increased in the last year by +12.1% to an average price per square foot of £1,604, this is still some 30% less than Mayfair or Knightsbridge, representing real value to potential buyers. The combined price advantage, lifestyle benefits and location of St John’s Wood all conspire to indicate that there remains substantial scope for further growth in this evergreen market for both sales and lettings.

Beauchamp Estates’ St John’s Wood office is located at 80, St John’s Wood High Street, London NW8. A full copy of ‘Prime Central London Markets: St John’s Wood’ report is available to download free of charge from the Beauchamp Estates website, under Publications.

For further information on Beauchamp Estates, please visit the website: www.beauchamp.com or telephone T: +44 (0)20 7722 9793.