The Crucial Contribution of Construction to Economic Recovery

In this article, Mike Bristow, CEO of CrowdProperty, examines how the construction industry will help the United Kingdom’s economic recovery in 2021.

2021 looked set to be a big year for housebuilding, with continued government support for the construction industry and news of a vaccine enabling cautious optimism for the prospect of a rebound in the global economy. As January 2021 saw the enforcement of a third national lockdown and the completion of Brexit, will this confidence endure?

Following a rapid rise in infections, hospital admissions and case rates across the country, Boris Johnson announced the need for lockdown restrictions to be reintroduced on 5th January. Government guidelines stated that the housing market would remain open, with business secretary Kwasi Kwarteng penning an open letter to the construction industry stating: “It is vital that construction continues through these unsettling times… the government values the crucial contribution [the] sector is making.”

I’ve mentioned before CrowdProperty’s belief that empowering the multitude SME property development businesses is the secret to delivering “build, build, build” and a key part of economic recovery. The latest IHS Markit / CIPS UK Construction PMI reported the continued recovery of the construction sector – led by house building – with Tim Moore, Economics Director at IHS Markit, commenting: “December data illustrated a positive end to the year for the UK construction sector, mostly fuelled by a sharp rebound in house building. Overall output growth has slowed in comparison to the catch-up phase last summer, but now it is encouraging to see the recovery driven by new projects and stronger underlying demand. A sustained improvement in construction order books resulted in a rise in employment numbers for the first time in nearly two years and the most optimistic growth expectations since April 2017.”

Whilst it’s not quite business as usual, experience gained through the previous lockdowns means that developers are able to progress projects thanks to the stringent safety measures in place. As Dr Howard Archer, EY Item Club’s Chief Economic Advisor, notes: “Over the course of 2020, the economy has become quicker to adapt to new COVID-19 restrictions and while new restrictions may still cause disruption, lessons learned from previous lockdowns are rapidly being put into place.” Indeed, the Construction Leadership Council (CLC) recently updated its site operating procedures – advising contractors to take action if five or more cases are identified within 14 days, under new Public Health England guidance.

Rishi Sunak’s announcement in July last year that homes costing up to £500,000 would be exempt from stamp duty has been a key driver for housing market activity. With the stamp duty holiday due to end on 31st March, Zoopla reports that there have been industry calls for the relief to be extended, with Property Week also claiming that there is cross-party support for an extension. Buyers who have agreed sales with a view to beating the impending tax deadline will be keeping their fingers crossed, as Rightmove estimates that the current “processing logjam” – created in part by the temporary stimulus measure – could lead to around 100,000 transactions missing out on the stamp duty savings.

The Financial Times suggests that an extension is unlikely: according to the Treasury, the “several billion pounds a year” that is typically raised through stamp duty is needed to fund essential public services with a view to restoring order to public finances. The policy succeeded in its aim of supporting the property market and protecting jobs in the industry – an extension of a few months would just defer the “cliff edge”, unless the reintroduction was tapered. The last time a stamp duty holiday was withdrawn, after the financial crisis in 2008, the surge in sales it prompted fell away sharply for a short while (as shown in the below graph) – little wonder then that estate agents and property professionals alike are asking for the deadline to be reconsidered.

The strong performance of the housing market last year in spite of the pandemic and recession may have been welcomed by sellers and the wider economy, but the impact on first-time buyers has not been as positive. The Financial Times asserts that the latest housing boom has been driven by wealthier homeowners, with the pandemic trend of richer city dwellers moving to more rural locations. News of rapidly increasing house prices during 2020 was rife, influenced by demand exceeding supply, leading Savills to report a rise in homes valued at £1m+ across the country.

Although the number of mortgage approvals soared to a 13-year high in 2020, Zoopla reports that there is an ongoing trend of the homeownership rate falling among young people – despite several recent government schemes aimed at supporting people to get on the property ladder. The proportion of people aged under 45 who own their own home has decreased by more than 10% during the past decade. This is not only due to house price growth outstripping increases to average earnings, but also as a result of changes in the mortgage market, with lenders withdrawing low-deposit mortgages and affordability rules making it harder for those on lower salaries to qualify.

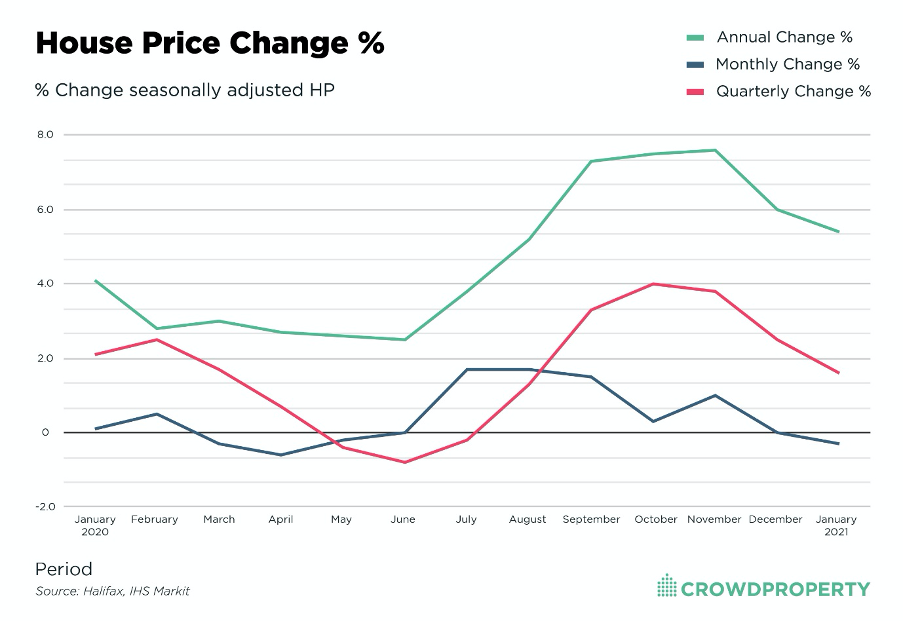

Whilst house prices were at a record high at the end of 2020, both Halifax and Nationwide comment that house price growth has now slowed with early signs that the market could start to cool in their latest House Price Index releases.

Russell Galley, Managing Director at Halifax, commented that “there may be enough residual strength in the market to sustain prices up to the deadline for the stamp duty holiday and the scaling back of Help to Buy at the end of March. However, with the pace of the UK’s economic recovery expected to be constrained by the renewed national lockdown, and unemployment widely predicted to rise in the coming months, downward pressure on house prices remains likely as we move through 2021.”

Robert Gardner, Nationwide’s Chief Economist, supported this viewpoint: “If the stamp duty holiday ends as scheduled, and labour market conditions continue to weaken as most analysts expect, housing market activity is likely to slow, perhaps sharply, in the coming months.”

Regarding the outlook for economic recovery, EY ITEM Club has improved its estimate of the UK’s economic performance in 2020 – claiming that the UK economy shrank by 10.1% in 2020, an improvement on its December estimate of 11.6%. Although GDP is expected to fall by 3% to 4% quarter-on-quarter in the first three months of 2021, the outlook is optimistic with forecasted growth of 5% in UK GDP in 2021 and 6.5% in 2022. Similarly, Capital Economics predicts that the economy will return to its pre-pandemic size in Q1 2022 – implying that the government does not need to tighten fiscal policy to reduce the budget deficit and that the Bank of England will not need to launch more quantitative easing or resort to negative interest rates in the next two years.

Unemployment remains a key concern, with the Office for National Statistics reporting that the unemployment rate had risen to 5% for September to November 2020. The government reacted by extending the furlough scheme to the end of April 2021 in an attempt to stem redundancies, with EY ITEM Club now forecasting that the rate could peak at 7% around mid-2021 – significantly below the 9% to 10% that some forecasters were predicting.

The health of the property market is closely linked to the number of people in work – low unemployment levels mean increased certainty around job security and personal finances, typically boosting consumer confidence and leading to increasing demand. Whilst COVID-19 is having a greater impact on unemployment levels amongst renting demographic segments, research from Savills expects that falling unemployment and low interest rates in late 2021 will restore housing market demand with expectations of flat house price growth through 2021 as a whole, ahead of a return to growth through 2022 and beyond, which are views supported by all major agencies.

A strong housebuilding agenda remains underpinned by planning reform, fixed local housebuilding targets that seek to strike a balance between increasing delivery in areas of most need and where it can be accommodated and a focus on facilitating home ownership. Housebuilding is a valuable contributor to the economy, and whilst it’s no secret that the sector consistently under-delivers on housebuilding needs, the dip in construction starts in 2020 will mean less new-build housing supply into the 2021 market, further mitigating short-term demand-side pressures.

——